Let’s Talk… Financial Aid

Yes, Student Financial Aid Is Still Available—Apply Before the April 2nd Deadline

March 28, 2025

A solid financial aid package was instrumental to my pursuit of a higher education degree, as it is for many low-income, first-generation students from mixed immigration status families like mine. Without the state Cal Grant program and institutional aid from my university, I likely would not have graduated in a timely manner—or at all.

For me, financial aid made college attainable by making it affordable. Today, the need for financial aid support remains more critical than ever, primarily because the cost of living has risen dramatically – prices are now 23% higher than before the COVID-19 pandemic began in February 2020. As the cost of living rises, financial aid becomes more than just tuition assistance—it helps students cover essential expenses like housing, books, transportation, food, child care, and other basic living costs, making higher education more accessible.

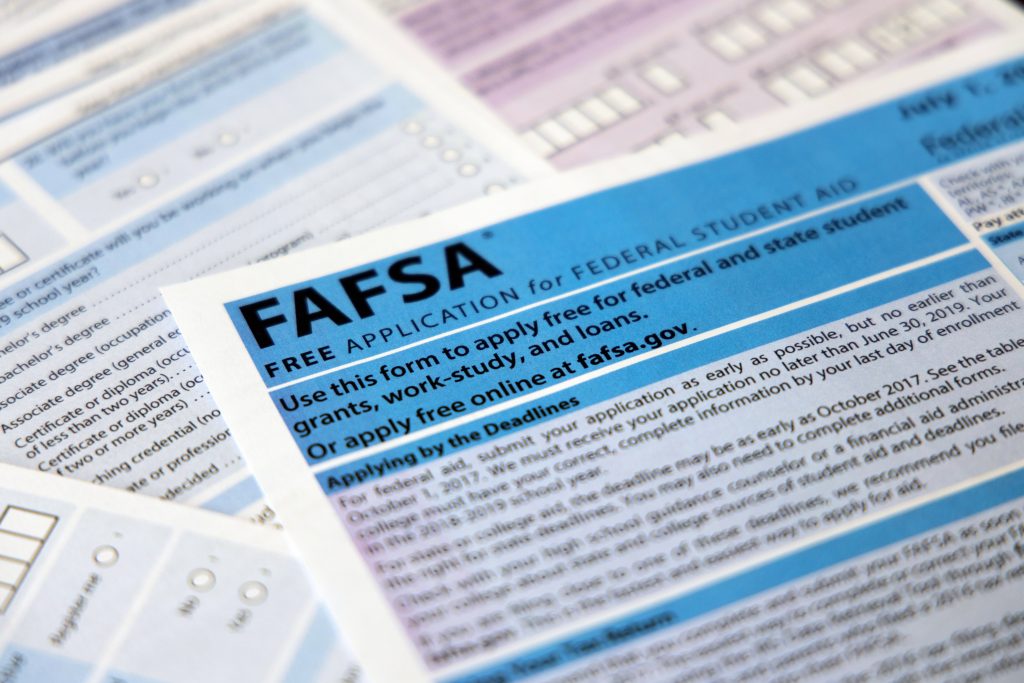

While financial aid remains a vital lifeline for many students, the process of applying for it has grown more difficult over the past few years—largely due to changes at the federal level. In 2020, the U.S. Department of Education was tasked with overhauling the Free Application for Federal Student Aid (FAFSA) to simplify the process. The new application promised to be faster and easier—allowing students and families to complete the process in under 15 minutes by linking directly to the Internal Revenue Service (IRS) and automatically populating their income and tax information. However, its rollout during the 2024-2025 application cycle was plagued by a delayed release and technical issues.

For those able to access it, the simplified application delivered on its promise but widespread technological glitches created major barriers for many applicants. Students reported issues with the application failing to save completed sections, crashing unexpectedly, or being inaccessible for hours at a time as the Department of Education worked to resolve backend problems. The most significant challenge, however, has been faced by students from mixed-status families (MSF). These are students who are U.S. citizens with parents or guardians who do not have a Social Security number (SSN).

The students from MSF were at first effectively locked out of completing the FAFSA because the new application requires a SSN—a requirement their parents or guardians cannot meet. This issue has been partially resolved, as workarounds are now available. Students from MSF can now complete the application by manually inputting their income and tax information and then verifying their contributor’s identity by submitting acceptable identification documents to the Department of Education. Needless to say, this process is tedious and time-consuming, as it requires manual verification by Department staff.

FAFSA Delays and Federal Uncertainty – What It Means for Students

This year’s financial aid cycle faces many of the same challenges as last year’s. Once again, the application’s release was delayed, technological glitches ensued, and a long-term solution for accepting and reviewing identity documents for students from mixed-status families has yet to be announced.

A key difference, however, is the federal response. Last year, the Department of Education under the Biden Administration actively monitored application issues, providing workarounds, solutions, and timelines for resolution. In contrast, the Trump Administration has stated the FAFSA application is fully functional—despite clear evidence from students and financial aid practitioners that significant problems remain.

Further complicating the situation, the Department of Education recently experienced significant workforce reductions, with more than 50% of its employees laid off by the Trump Administration. This means, solutions to issues with the financial aid application will likely be further impacted. Additionally, students attempting to contact the Department of Education’s call center for crucial assistance with completing their financial aid applications are unlikely to reach anyone to receive the help they need.

Significantly adding to the uncertainty, President Trump issued an Executive Order directing the Secretary of Education to take “all necessary steps to facilitate the closure” of the Department of Education. While the President does not have the authority to unilaterally abolish a federal department, this move has heightened concerns about the future of federal education policy. Beyond the political implications, it also creates confusion and unnecessary hurdles for college-bound students already struggling to access the financial aid they need.

Fortunately, California has resources that can help. Students that are in need of assistance regarding their financial aid applications can contact the California Student Aid Commission by phone at (888) CA GRANT (888-224-7268), or by email at: studentsupport@csac.ca.gov.

Understanding the Risks: FAFSA Data Privacy for Mixed-Status Families

Another emerging concern for mixed-status family students is the fear of sharing identifiable information with a federal administration that may use the application data to target them. This creates an additional barrier in filling out an application for federal financial aid for these students, who may be hesitant to disclose sensitive personal information due to potential risks.

FAFSA data is currently protected by federal laws and cannot be used for immigration enforcement. However, there is no guarantee these protections will remain in place. This uncertainty may cause students from mixed-status families to worry that submitting a FAFSA could put their undocumented contributors at risk.

Given these concerns, when considering whether to submit a FAFSA or not, it may be helpful for students from mixed-status families to assess whether their contributors’ personal information has already been shared with other federal agencies. For instance, contributors may have previously provided their information when filing taxes with the IRS, applying for immigration benefits through United States Citizenship and Immigration Services (USCIS), or obtaining a California driver’s license through the DMV. Additionally, if the student or their contributors have already created a StudentAid.gov account, having applied for financial aid previously, the U.S. Department of Education retains that information. Submitting a new FAFSA form would only update existing records with new details, such as changes in income or address.

Families should also consider whether the student or any older siblings have previously submitted a FAFSA. The U.S. Department of Education is required to retain applicant and contributor information for the duration of the student’s relationship with the Department. For example, if a student receives a Pell Grant, the Department will keep their information for the lifetime of the grant. Continuing students who have previously submitted a FAFSA can renew their application, meaning that much of their information is already on file. Understanding these factors can help families make informed decisions about submitting the FAFSA to access crucial federal financial aid while weighing concerns about data privacy and potential risks.

Students from mixed-status families who choose not to apply for federal financial aid due to these serious privacy concerns will forgo a good amount of financial aid, but are still eligible for state financial aid through the California Dream Act Application (CADAA). In response to the challenges to complete the FAFSA application by students from mixed-status families, California expanded access to the CADAA for these students. It is especially important for students from mixed-status families who have never applied for federal financial aid before and are confident their family members haven’t shared personal identifiable information for other federal government assistance programs to seriously review the CADAA.

Apply for Financial Aid by April 2nd!

Tumultuous times are upon us, but rest assured—financial aid isn’t going anywhere. Despite the uncertainty surrounding the Department of Education’s future, financial aid remains available. In California, there’s still time to apply—the priority deadline has been extended to April 2nd, giving students more time to secure the financial support they need to pursue a higher education degree.

Financial aid packages come in various flavors, including grants, scholarships, work-study, and loans. Each year, California students receive a total of $6 billion combined in federal and state financial aid. To access financial aid in California, you can apply through either the Free Application for Federal Student Aid (FAFSA) or the California Dream Act Application (CADAA). The FAFSA is an application operated by the federal government that allows students to qualify for federal, state, and institutional financial aid. Students are eligible to complete the FAFSA if they are a U.S. citizen, permanent resident, or an eligible non-citizen. Again, though, for students from mixed-status families, the decision to fill out a FAFSA will be a hard one, as discussed above. For more information, visit https://www.csac.ca.gov/apply.

The CADAA is California’s state financial aid application operated by the California Student Aid Commission and it allows undocumented and other eligible students to qualify for state and institutional financial aid. You are eligible to complete the CADAA if you are Undocumented, have a U-Visa or Temporary Protected Status (TPS), meet the CA non-resident exemption requirements, or are a student from a mixed-status family. Learn more here: https://www.csac.ca.gov/apply.

Visit NextGen Policy’s website to learn more about our education work. Also, stay tuned for more information about our ongoing efforts to ensure that financial aid remains a key tool in making ore college attainable and affordable for all. Sign up for updates and opportunities to get involved!

Thanks for reading,

Kimberly Sanchez