Let’s Talk… May Revise

What to Expect from the Governor’s Updated State Budget

May 8, 2024

The month of May is recognized as a time for spring flowers, Mothers’ Day, and warmer, more pleasant weather. In California state government, May is also known as a critical month for the state budget process because it is when the Governor provides the Legislature with comprehensive revisions to the state budget proposal that was introduced in January. The submission of May revisions to the January budget proposal is known widely, if not exactly grammatically, as “The May Revise” and kicks off the final, hectic weeks of the annual budget process.

This edition of NextGen’s Let Talk! provides an overview of the May Revise. After reading this post, you’ll hopefully have a better understanding of why the May Revise is a highly anticipated and carefully scrutinized event for anyone interested in California state policy. Who knows, it … may … even become another thing you start looking forward to every spring.

State Budget Overview

Before talking about the nuts and bolts of the May Revise, it helps to broadly understand a few elements of California’s overall budget process. I would also note that the budget is considered the ultimate values statement by the Governor because it reflects his/her priorities for where the state should be spending its money. On any given day, California is either the fourth or fifth largest economy in the world and our annual state budget is over $200 billion.

California’s Constitution requires that all spending from the State Treasury must be authorized by an “appropriation” in state law. In general, an appropriation is a legal authorization for a state entity to spend money from a specific state fund for a specific purpose within a specific period of time. The state’s annual Budget Act is a lengthy, detailed piece of legislation that contains the vast majority of the appropriations that govern state spending in each of the state’s fiscal years.

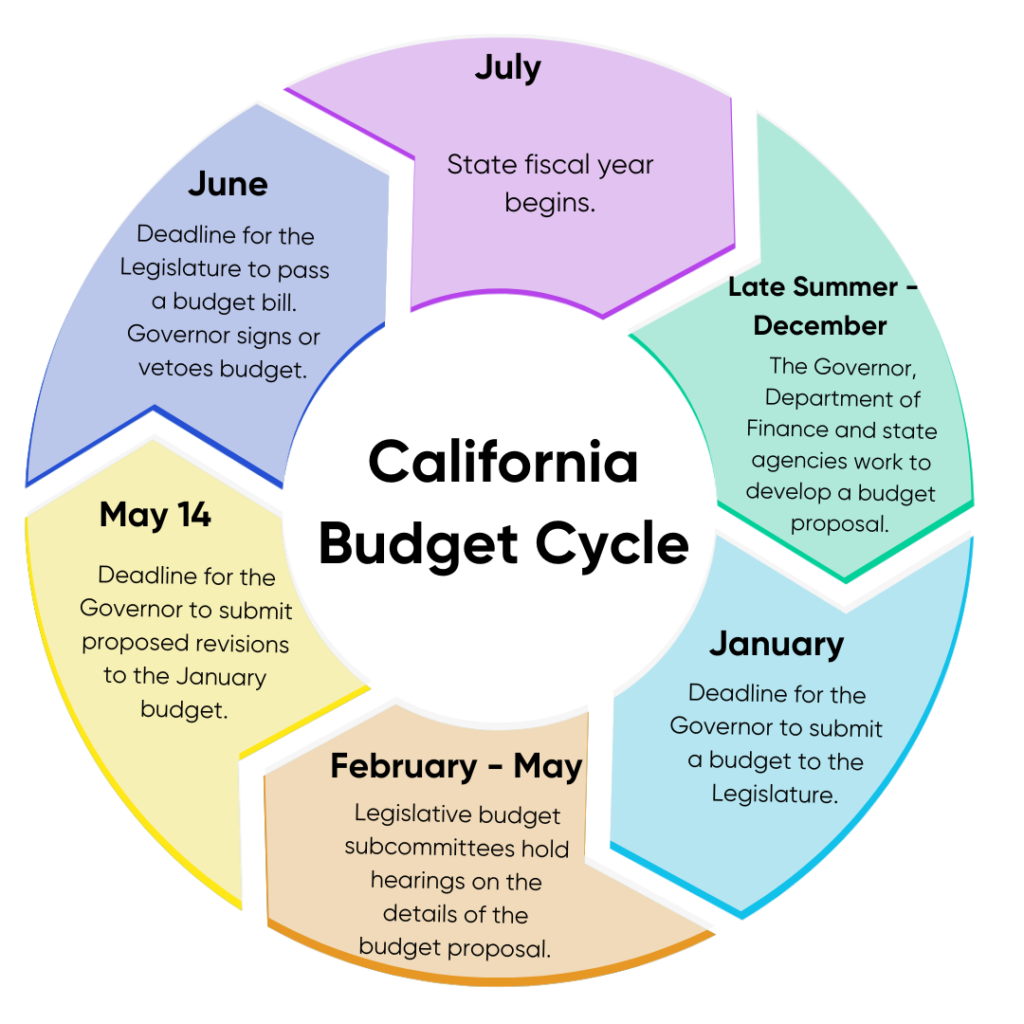

The Governor must submit, by January 10th each year, a proposed budget that balances all of the state’s anticipated spending with its anticipated revenues for the coming fiscal year. Now the budget is in the Legislature’s hands and each house starts the budget process by introducing a bill reflecting the Governor’s proposed budget. They then begin to hold hearings from February through May on their recommendations to adopt, reject, add, or change elements in the Governor’s proposed budget. (This year, the budget bills are AB 1812 and SB 917).

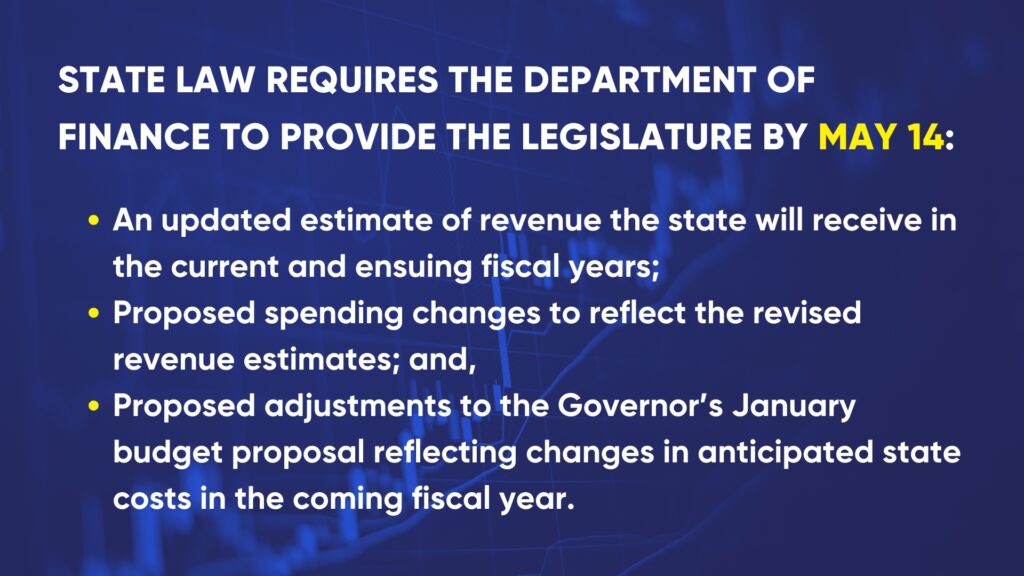

On or before May 14, the Governor can submit proposed changes (aka “May revisions”) to the January budget proposal for consideration by the Legislature. The State Constitution requires the Legislature to pass a budget bill by June 15th with the final budget bill language released publicly on or before June 12, because bills must be in print for 72 hours before a legislative vote. The budget bill, when signed by the Governor, is enacted into law as the “Budget Act” for the fiscal year that begins July 1. The Governor also has the option of vetoing a budget bill or may veto portions of a budget bill to reduce spending and sign the remainder of the bill into law.

The budget process is a year-round activity involving numerous participants across different branches and levels of government and from outside of government, who all have a role and interest in determining what the state spends public money on, how much the state spends, and what sources it uses to pay for its spending. These additional elements of the budget process are beyond the scope of this blog post.

How Does the May Revise Fit Into the State Budget Process?

These revisions are needed because the Governor’s January budget proposal relies on revenue and expenditure data from the previous November and December. Data generated after the current year’s April 15th deadline for filing state income taxes does not generally play a role in the budget process until the next budget cycle. Improved revenue projections, along with more current macroeconomic data, also help to more accurately project some types of state expenditure obligations in the coming year. For example, the minimum amount that the state is required to spend on K-12 schools and community colleges, which accounts for roughly 40 percent of all state General Fund spending in most years, can vary substantially based on changes in the amount of revenue received by the state in a particular year.

The May Revise is, essentially, the Governor’s opportunity to use the most current and accurate fiscal projections available to suggest changes to the January budget bill proposal, which was based on less reliable data. In turn, these updated projections and suggested changes to the January budget influence legislative decisions about how to draft a final version of the budget bill to pass and send to the Governor by June 15th.

So, What’s the Big Deal About the May Revise?

The May Revise plays at least two important roles in determining the size and structure of each year’s state budget.

First, there can be significant changes in state revenues and economic conditions between January and May that require changes to the budget proposal that was released in January. This year, for example, there is concern among some observers that the assumptions underlying the Governor’s January proposal were overly optimistic. If the May Revise reflects a deterioration in state revenue projections, the version of the budget bill passed by the Legislature will need to include additional expenditure reductions, borrowing, revenues, or some combination to balance the state’s budget. The most dramatic recent example of the May Revise being used to adjust to major fiscal and economic changes was in 2020, when the repercussions of a global pandemic that hit in March meant that the state’s fiscal outlook in May of 2020 was wildly different from what it was in January 2020.

During years in which there are likely to be substantial changes in the state’s fiscal conditions between January and May, many stakeholders in the budget process engage in advocacy with the Governor, the Department of Finance, State Agencies, and the Legislature. They will either seek to protect spending priorities that they care about from cuts or seek to put favored spending priorities at the front of the line for additional appropriations, depending on what changes are anticipated in the May Revise.

Additionally, regardless of whether there are likely to be substantial changes in fiscal conditions in any year, the May Revise provides the Governor with a powerful tool that can be used to frame and set the terms of debate over the final structure of each year’s state budget. The release of a Governor’s May Revise proposal provides a highly-publicized platform for a Governor to push particular policy and spending priorities to the center of debate over the coming year’s budget. It can frame public perceptions about the relative merits of new spending vs. reductions in spending or new taxes vs. tax cuts. While the Legislature is not bound to adopt any of the Governor’s recommendations, a Governor can strengthen his or her position in budget negotiations with the Legislature by strategically including or excluding elements in the May Revise.

This year, there is reason to believe that actual state revenues will be below the revenue projections used for the Governor’s January budget. As a result, the May Revise is likely to include additional proposals for reducing spending, borrowing funds, adjusting the timing of state payments, increasing revenues, and other strategies to close the gap between what money the state spends and what it receives in the coming fiscal year.

Although not as fun as enjoying warmer weather or a field of California poppies in full bloom, the May Revise is another annual springtime event that has importance for all Californians. If this summary of the May Revise has you wanting to learn more about this year’s state budget process, additional information is available through these resources:

- The Department of Finance posts a summary and full details of the Governor’s May Revise budget here.

- Amendments to the two budget bills reflecting the May Revise proposals can be found through the AB 1812 and SB 917 pages on the California Legislative Information website.

- The non-partisan Legislative Analyst’s Office (LAO) produces summaries and commentary on the May Revise, which can be found in the budget section of the LAO website.

Thanks for reading,

Brian Weinberger