Let’s Talk… May Revise Summary

Taking a Closer Look at the Budget Cuts and Program Changes Included in Governor Newsom’s May Budget Revision

May 29, 2024

A frequently-cited bit of military wisdom is that “no plan survives first contact with the enemy,” underscoring the importance of being able to adjust initial plans in response to real-world conditions. Whether someone is spontaneously revising travel plans to visit other destinations and make a family vacation more memorable or changing the scope of and delivery timelines for construction projects to take into account cost pressures or material delivery delays, the process of revision is vital to many parts of our work and life – and that includes how the California state budget is formulated.

This edition of NextGen’s Let’s Talk blog builds upon our prior post about the “May Revise” and the role it plays in California’s budget process, by taking a deeper dive into what the Governor recently proposed in his May Revision proposal for the coming fiscal year.

Earlier this month, Governor Newsom announced his Administration’s revisions to his January state budget proposal. As described in a previous Let’s Talk blog post, the May Revision to the Governor’s January budget proposal is generally released in the mid-May timeframe and plays an important role in finalizing California’s state budget for the upcoming year. The May Revise adjusts state spending levels to more accurately reflect current fiscal conditions and program workloads as well as provides greater detail to new programs and initiatives that were part of his January budget proposal. The spending changes and program updates in the May Revision also allow the Governor a timely and strategic opportunity to reestablish his priorities and better define the contours of budget negotiations with the Legislature, given that the two parties have to come to a final agreement by mid-June. So, what’s important to know about this year’s May Revise?

State Budget Outlook is Worse Than Projected in January

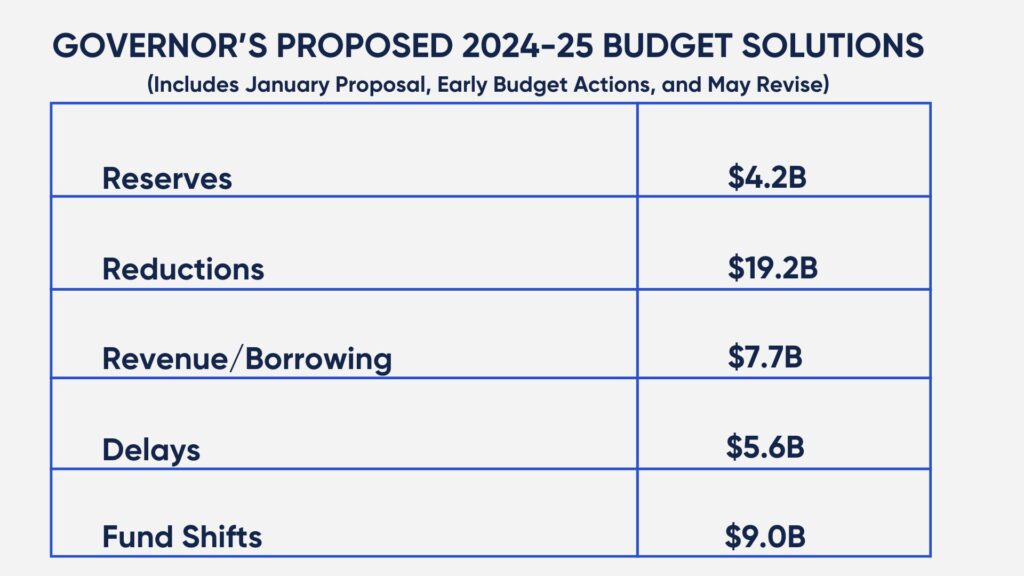

The Governor’s January budget proposal identified a nearly $38 billion shortfall – this projected deficit was based on the data that was available at the time (basically, the end of December 2023). As a result of this information, the Legislature and Governor enacted a package of early budget actions that addressed $17.3 billion of the shortfall. However, lower-than-projected state revenues during the spring months resulted in an additional $7 billion estimated shortfall that is reflected in the May Revise. As a result, the Governor’s May Revise proposal seeks to close a total remaining budget problem of $27.6 billion.

Beyond the 2024-25 fiscal year, the May Revise projects continued deficits and proposes that the Legislature adopt budget changes to close an estimated $28.4 billion deficit in the 2025-26 fiscal year.

These funding shortfalls are a stark contrast to some recent years in which the state projected substantial surpluses. The size of the deficit will force policymakers to make difficult decisions to balance the budget – program cuts and delays, fund shifts and borrowing, and the other responses necessary to bring the state budget into balance.

The May Revise Proposed Hundreds of Budgetary Changes

To address the current budget shortfall, the May Revise includes a combination of more than 230 proposals for funding cuts, funding deferrals, fund shifts, borrowing and revenues that, in combination with proposals from the January budget, are projected to bring next year’s state budget into balance.

The May Revision budget changes include $10.7 billion in reduced spending, $3.9 billion in fund shifts, $2 billion in borrowing and new revenues, and $0.5 billion in funding delays. The May Revise also proposes lowering the amount of reserves used in the coming fiscal year by $8.9 billion, saving more reserve funds to help close the deficit in the following year. Taken together, these changes comprise an additional $8.2 billion in budget solutions, compared to the January budget proposal.

Examples of some of the most significant proposed budget adjustments include:

- An across-the-board reduction of nearly 8% in state administrative spending for purposes including personnel, operations, and contracting.

- Reduced healthcare workforce expenditures of more than $300 million in the coming year.

- A reduction of $260 million in funding for the Homeless Housing and Assistance Program.

- Shifting more than $500 million in General Fund transit investments to the Greenhouse Gas Reduction Fund, a special fund generated by the state’s cap-and-trade program.

- Shifting $700 million in funding for the Capitol Annex Replacement Project to lease revenue bonds instead of General Fund expenditures.

- Suspension of a corporate tax deduction program that will result in an estimated $900 million in additional revenue in the next fiscal year and potentially more than $5 billion in subsequent years.

The Proposal Seeks to Reduce California’s Budget Volatility

One unique and potentially significant aspect of this year’s May Revise is that it proposes budget changes that seek to balance not only the budget for the next fiscal year (2024-25), but also the following budget year (2025-26). California’s recent pattern of revenue volatility, which results primarily from California’s disproportionate reliance on capital gains tax revenues from the state’s highest-earning taxpayers, makes it difficult to enact accurate long-term spending decisions. By proposing that the Legislature enact spending adjustments over a two-year period, the May Revise seeks to bring more stability into the budget process. In related proposals to address revenue volatility, the May Revise suggests changing state law to allow the state to set aside more reserves during future years in which revenues spike upwards and to require the state to avoid making some spending commitments until anticipated surplus revenues have been realized.

Impacts on NextGen’s Work

By delaying certain programs or cutting funding for other programs, several of the May Revision’s proposed budget changes would have a negative effect on NextGen’s priorities in the coming years including in the climate, health, food insecurity, higher education finance, and broadband equity spaces. Among the proposals of concern are cuts to funding that supports the state’s social safety net –healthcare and food insecurity programs – as well as cuts and delays to funding for the California Climate Commitment and Cal Grant reform. However, NextGen continues to fight to advance policies and programs that address equity-centered issues impacting California’s frontline communities by identifying opportunities for progress that can be made despite California’s fiscal challenges. NextGen’s general response to the Governor’s May Revision proposals can be read here and our specific response to the climate-related implications of the May Revision can be read here.

They’re in the Homestretch

The release of the May Revise typically marks the beginning of the end of the state’s annual budget process. Shortly after the May Revision is released, the Legislative Analyst Office (LAO) typically publishes reports summarizing and reviewing the pros and cons of the various May Revision proposals. During this timeframe, the Senate and Assembly Budget Committees hold hearings to analyze the details of the May Revision and vote to affirm or deny its various elements. In early June, the legislative leadership and the Governor’s Administration typically sit down to engage in the very tough negotiations needed to construct and finalize the state’s budget framework. The Constitution requires the Legislature to pass a balanced budget by June 15th and send it to the Governor. To meet the requirement that bills be in print for 72 hours before a floor vote, the final budget bill will typically be released on or before June 12th. Once voted on by the Legislature, the Governor has until June 30th to blue pencil (aka line-item veto) any items. The Governor may make additional cuts to the budget the Legislature passes, he can not make additions). The Governor must ultimately veto or approve the final budget before the new fiscal year begins on July 1st.

Sources for Additional Information

If you want even more information about this year’s California State budget process, here are some important sources for you to check out before a new budget is (likely) passed by June 15th and signed into law by July 1st:

Department of Finance (DOF)

- A summary and full details of the revised budget can be accessed through the Department of Finance’s budget website.

- The Department has compiled a full list of the proposals that were included in the May Revise to address the General Fund deficit.

- Finance letters contain the details of each of the administration’s proposed amendments to revise the Governor’s proposed January budget, as reflected in the budget bill.

- Budget change proposals (BCPs) are documents submitted by state agencies and departments that propose changes to the level of service or funding source for a currently authorized program or propose a new program. A full list of this year’s BCPs that identifies which BCPs are related to the May Revise can be found here.

State Legislature

- The budget bills for this year are AB 1812 and SB 917.

- The Assembly Budget Committee’s website contains information about the full committee and subcommittee hearings on the state budget as well as documents and reports relating to the current and past-year budgets.

- Similarly, the Senate Budget and Fiscal Review Committee’s website contains information relating to the committee’s budget hearings as well as information about current and historic budgets, including a summary of this year’s May Revise proposal.

Legislative Analyst’s Office (LAO)

- Dozens of LAO reports analyzing various aspects of this year’s state budget, including a response to the May Revise proposal, can be found on the LAO’s 2024-25 Budget page.

Thanks for reading,

Brian Weinberger